Scroll down to read this message in Spanish. Vaya hacia abajo para leer este mensaje en español.

For 90 years, Culinary Union has fought and won for working families in Nevada. Since November 1, 1935, generations of cooks, guest room attendants, servers, and kitchen workers have built a movement that transformed this state.

Culinary Union members organized to build what working families needed most - security. In nine decades, we are proud to have created the Culinary Health Fund, the Pension Fund, the Culinary Academy of Las Vegas, the Citizenship Project, the Housing Fund, the Legal Service Fund, and now, our network of 4 Culinary Health Centers deliver world-class care to over 120,000 Culinary Union members and their families.

As we continue to celebrate the Culinary Union’s 90th anniversary, we honor every member who marched, struck, sacrificed, and organized to build this union, but our fight isn’t over.

Station Casinos workers and 10,000 non-union restaurant workers on the Las Vegas Strip are organizing to win the Las Vegas Dream, and we have their backs.

For nearly a century, the Culinary Union has been the beating heart of working-class power in this state, and we will continue to organize, strike, and vote to protect what our parents and grandparents built.

Some of the highlights from the past year:

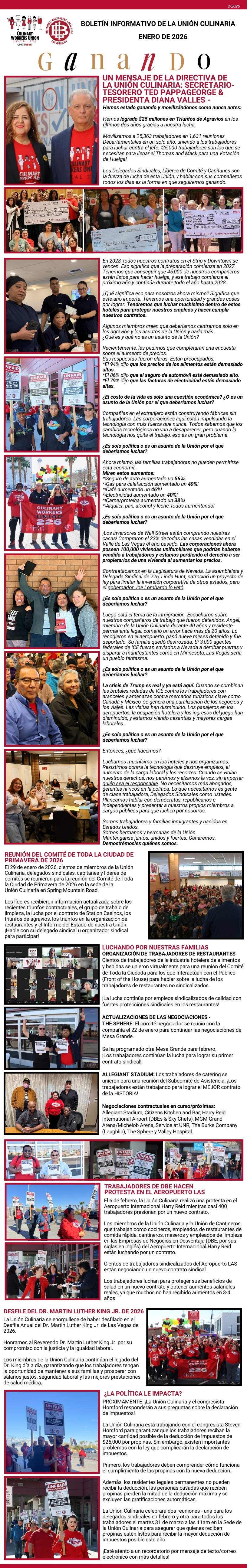

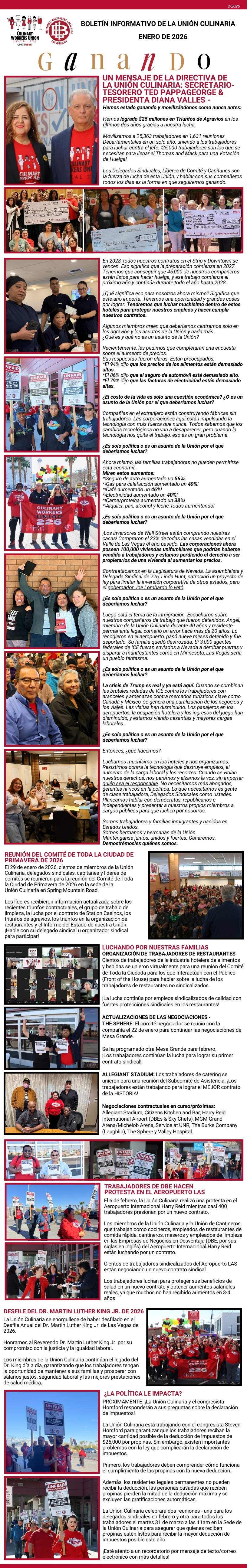

*In 2025, Culinary Union won a new contract at Virgin Las Vegas after the longest strike in more than two decades. For the first time in more than 20 years, the Culinary Union led its longest strike, taking workers at Virgin Las Vegas out in an open-ended strike that began November 15, 2024 and ended 69-days later on January 22, 2025. We fought for and won a new 5-year union contract for 700 hospitality workers.

*For the first time in Culinary Union’s 90-year history, 100% of all casino resorts on the Las Vegas Strip are unionized. The Culinary Union celebrates this historic milestone, recognizing generations of hospitality workers who organized and sacrificed to win a better future for working families.

*On April 2, 2025, the Culinary and Bartenders Unions, together with the Culinary Health Fund, hosted the grand opening of the third state-of-the-art Culinary Health Center. Located in North Las Vegas, the Culinary Health Center - Craig provides expanded access to high-quality primary and preventive care for tens of thousands of union members and their families. The fourth Culinary Health Center - Tropicana opens in 2026!

*Culinary Union relocated its headquarters from Downtown Las Vegas to a new campus on Spring Mountain Road. The new Culinary Union campus is a wise investment that makes our union stronger, ready to take on big corporations, and win strikes. It is a source of power and financial security for our union family - for now and the next 90 years.

We’re going to keep fighting for workers in this city, from the casinos in Downtown Las Vegas to the non-union restaurants on the Las Vegas Strip. Here’s to the next generation of organizing, fighting, and winning!

Durante 90 años, la Unión Culinaria ha luchado y ganado por las familias trabajadoras de Nevada. Desde el 1 de noviembre de 1935, generaciones de cocineros, recamareras, meseros y trabajadores de cocina han construido un movimiento que transformó este estado.

Los miembros de la Unión Culinaria se organizaron para construir lo que las familias trabajadoras más necesitaban: seguridad. En nueve décadas, nos enorgullece haber creado el Fondo de Salud Culinaria, el Fondo de Pensiones, la Academia Culinaria de Las Vegas, el Proyecto de Ciudadanía, el Fondo de Vivienda, el Fondo de Servicios Legales y, ahora, nuestra red de 4 Centros de Salud Culinaria que brindan atención de primer nivel a más de 120.000 miembros de la Unión Culinaria y sus familias.

Mientras celebramos el 90 aniversario de la Unión Culinaria, honramos a cada miembro que marchó, hizo huelga, se sacrificó y se organizó para construir esta unión. Pero nuestra lucha no ha terminado.

Los trabajadores de Station Casinos y 10.000 trabajadores no sindicalizados de restaurantes en el Strip de Las Vegas se están organizando para ganar el Sueño de Las Vegas, y cuentan con todo nuestro respaldo.

Durante casi un siglo, la Unión Culinaria ha sido el corazón del poder de la clase trabajadora en este estado. Vamos a seguir organizándonos, haciendo huelga y votando para proteger lo que nuestros padres y abuelos construyeron.

Algunos de los logros más importantes del último año:

*En 2025, la Unión Culinaria ganó un nuevo contrato en Virgin Las Vegas después de la huelga más larga en más de dos décadas. Por primera vez en más de 20 años, la Unión Culinaria lideró su huelga más larga, sacando a los trabajadores de Virgin Las Vegas a una huelga indefinida que comenzó el 15 de noviembre de 2024 y terminó 69 días después, el 22 de enero de 2025. Luchamos y ganamos un nuevo contrato de unión de 5 años para 700 trabajadores de hospitalidad.

*Por primera vez en los 90 años de historia de la Unión Culinaria, el 100% de todos los resorts de casino en el Strip de Las Vegas están organizados con la unión. Celebramos este logro histórico, reconociendo a generaciones de trabajadores de hospitalidad que se organizaron y se sacrificaron para ganar un mejor futuro para las familias trabajadoras.

*El 2 de abril de 2025, las Uniones Culinaria y de Bartenders, junto con el Culinary Health Fund, celebraron la gran apertura del tercer Centro de Salud Culinario de última generación. Ubicado en North Las Vegas, el Centro de Salud Culinario - Craig amplía el acceso a atención primaria y preventiva de alta calidad para decenas de miles de miembros y sus familias. ¡El cuarto Centro de Salud Culinario - Tropicana abrirá en 2026!

*La Unión Culinaria trasladó su sede del centro de Las Vegas a un nuevo campus en Spring Mountain Road. El nuevo campus es una inversión inteligente que fortalece a nuestra unión, nos prepara para enfrentar a grandes corporaciones y ganar huelgas. Es una fuente de poder y estabilidad financiera para nuestra familia de la unión, ahora y durante los próximos 90 años.

Vamos a seguir luchando por los trabajadores de esta ciudad, desde los casinos del centro de Las Vegas hasta los restaurantes no organizados en el Strip. ¡Aquí seguimos, organizándonos, luchando y ganando para la próxima generación!

Scroll down to read this message in Spanish. Desplácese hacia abajo para leer este mensaje en español.

Scroll down to read this message in Spanish. Desplácese hacia abajo para leer este mensaje en español.